most popular pet health insurance choices explained calmly

Popularity can be reassuring, yet policies vary more than marketing suggests. A careful read beats assumptions, and predictable claims matter more than hype.

What "popular" often signals

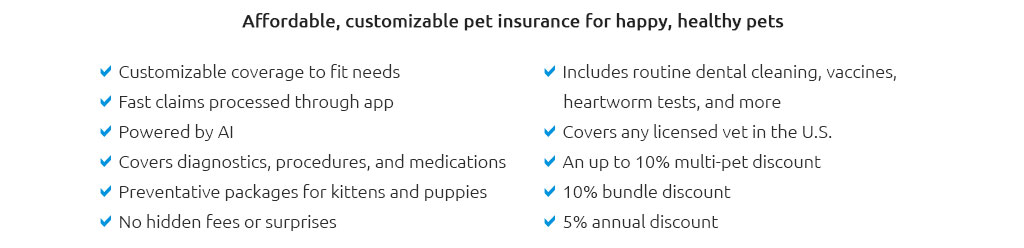

- Broad acceptance by vets: most clinics can submit or guide you through claims.

- Stable apps and portals: policy IDs, invoices, and claim status in one place.

- Transparent pricing tools: sliders for deductible, reimbursement, and annual limit.

- Large customer base: more data on claim timelines and service patterns.

- Consistent support hours: chat or phone that actually picks up.

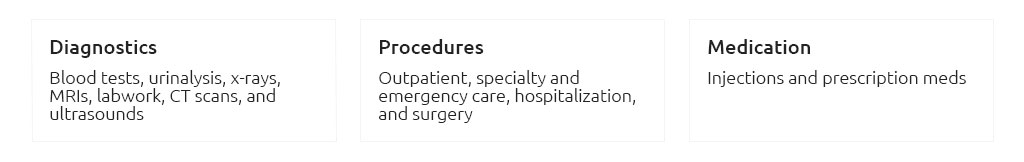

Coverage essentials vs. nice-to-haves

- Accidents and illnesses: the core. Look for clear definitions.

- Hereditary and congenital conditions: included by many leaders, sometimes with waiting rules.

- Exam fees: commonly optional; check if "sick visit" exams are reimbursable.

- Dental illness: not just trauma - read the fine print for periodontal limits.

- Rehab and alternative therapies: acupuncture, PT, hydrotherapy may require add-ons.

- Prescription diets and supplements: often excluded unless for specific diagnoses.

Exclusions and waiting periods to watch

- Pre-existing conditions: nearly always excluded; some offer curable-condition lookbacks.

- Bilateral issues: one knee today can affect coverage for the other tomorrow.

- Cruciate/hip waiting periods: longer than accident coverage; verify days, not guesses.

- Age constraints: enroll early; late starts can narrow options and raise cost.

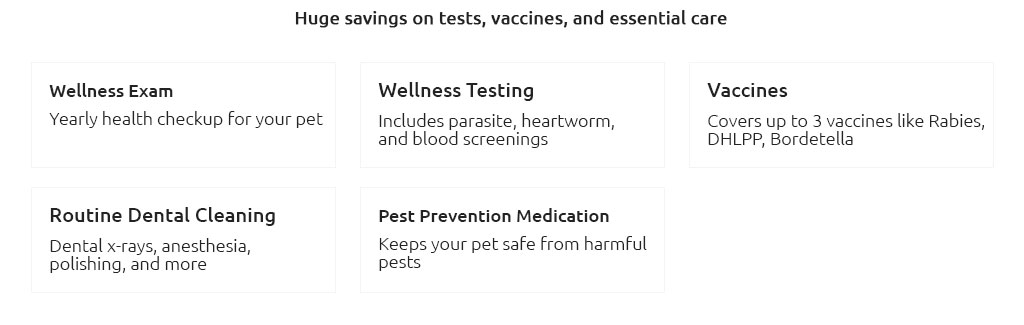

- Routine care riders: wellness isn't insurance; treat it as a budget tool, not risk transfer.

Price, deductibles, and reimbursements

Popular plans usually let you adjust the annual limit, deductible, and reimbursement percentage. Higher deductibles can steady monthly costs but shift more to you during a bad month. Expect rates to update at renewal as your pet ages and vet costs change; a gentle trend is good, big jumps deserve a comparison quote - without panic.

A simple 10-minute comparison

- Open each policy's sample terms and skim coverage, exclusions, and definitions.

- Confirm waiting periods for accidents, illnesses, and cruciate/hip.

- Toggle deductible and reimbursement until your worst-case out-of-pocket feels tolerable.

- Check if exam fees and dental illness are included or add-ons.

- Review claim submission methods (app photo, portal, email) and typical timelines.

- Ask your vet if they'll help submit or offer any direct pay arrangements.

Trust and usability cues

- Clear, plain-language policy with examples beats glossy brochures.

- Reliable app that doesn't crash mid-claim; two-factor sign-in is a plus.

- Published average claim turnaround with supporting data.

- Complaint trends that look steady, not spiky.

- Proactive renewal notices explaining changes before they hit.

A quiet real-world moment

After a late-day ear infection visit, I snapped a photo of the invoice in the parking lot and filed through a popular insurer's app; the claim ID arrived before the dog settled in the back seat. We'd already checked that exam fees were on our plan, which kept the reimbursement predictable.

Why popular plans can help - and where to be careful

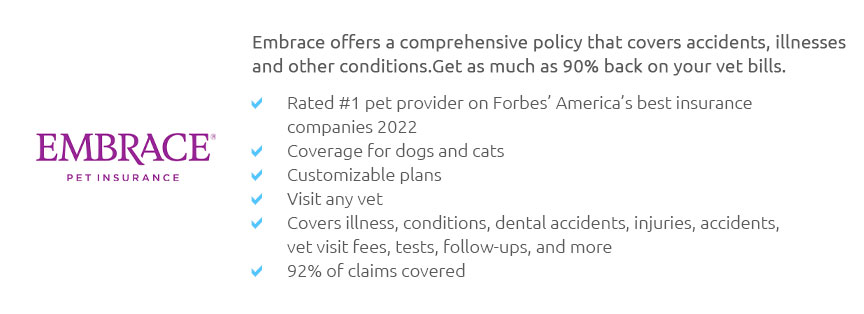

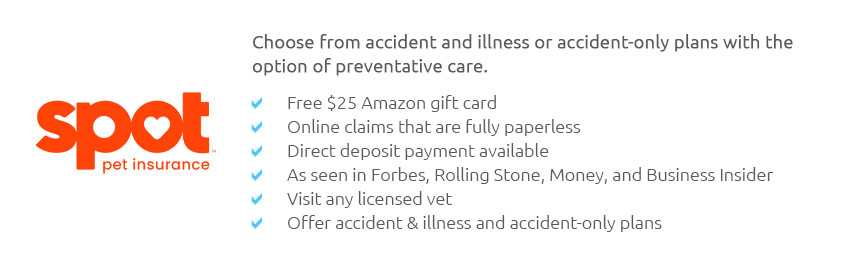

- Pros: smoother apps, more vet familiarity, clearer add-ons, and broader condition lists.

- Caution: promotional prices may rise at renewal; read the policy, not the postcard.

- Pros: faster customer service and well-documented FAQs.

- Caution: per-incident or bilateral limitations can surprise if you skim.

Who might benefit

First-time pet owners, families needing straightforward support, and anyone who values quick, dependable claims over shaving the last dollar off premiums may find the most popular options comfortable to live with.

When a niche plan could fit better

If you rely on specific therapies, have breed risks the mainstream treats cautiously, or want unusual reimbursement rules, a smaller specialist may align better - after verifying stability and service.

Practical pre-enrollment checklist

- Confirm hereditary/congenital coverage in writing.

- Note waiting periods by condition category.

- Decide on exam fee and dental illness add-ons.

- Estimate a worst-case year and test your deductible fit.

- Save the sample policy PDF and claim instructions.

- Set a calendar reminder to review 30 days before renewal.

Common myths to retire

- "Popular means cheapest." It often means predictable and serviceable, not lowest cost.

- "Everything at the vet is covered." Routine care and pre-existing conditions usually aren't.

- "Direct pay is guaranteed." It's rare; plan for reimbursements unless your clinic confirms otherwise.

A measured closing note

Trust grows from clear terms, steady service, and usable tools. Start with coverage you understand, keep records tidy, and revisit your settings as your pet and budget change; there's room to refine from here.